Prepared for opportunity amid a changing economic backdrop

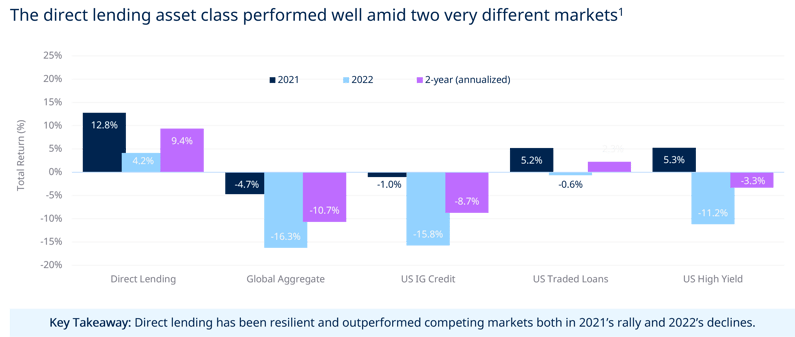

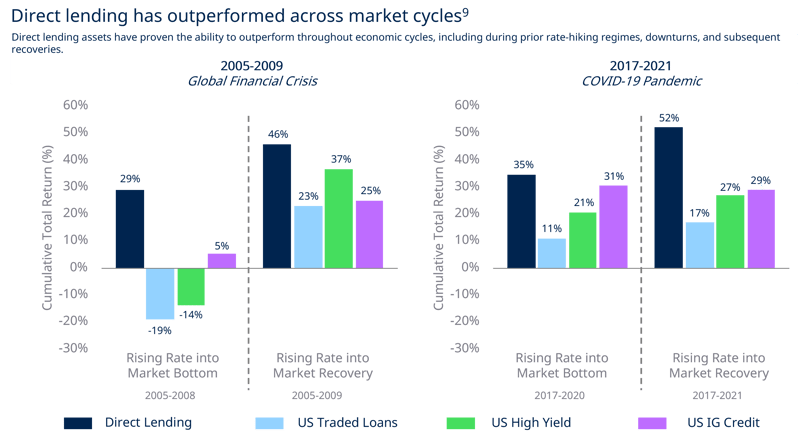

Our message in 2022 was to “Stay the Course”: to maintain a constructive stance even with the expectation for greater uncertainty as both the Fed policy directive and economy transitioned. Several headwinds this past year increased market volatility, including heightened inflation, rising interest rates, and supply chain disruption. Despite these challenges, direct lending proved resilient, meaningfully outperforming traditional fixed income and traded credit markets, and with less volatility.

Looking ahead to 2023, it is widely expected that rates will remain elevated before an eventual Fed pivot, and risk that the US could enter recession, although the severity and length of any such downturn remains unclear. In a more favorable scenario, the contraction would be manageable and short-lived, consumer demand would not deteriorate, and most of the economy would emerge relatively unscathed. A more challenging scenario may mean a protracted downturn, continued stagflation, and elevated unemployment. In the absence of a crystal ball and with a lender’s focus on downside scenarios, we must prepare for the worst as we hope for the best, while acknowledging potential demand headwinds for businesses ahead.

From our vantage point, we believe the direct lending asset class and the Blue Owl Credit platform are well positioned not only to weather the next twelve to eighteen months, but also to deliver attractive risk-adjusted returns. Because our loans are floating rate, their contractual returns have increased as rates have risen, driving continued expansion in the earnings power of our portfolios. Fundamentally, our borrowers are largely entering 2023 from a position of strength. In addition, the opportunity set for direct lending is among the most compelling we have seen since the inception of our firm in terms of credit quality, pricing, and lender protections. We maintain ample dry powder to take advantage of this backdrop and believe lenders with scale could disproportionately benefit.

Blue Owl's five investment themes for direct lending in 2023

1. One of the best investing environments for direct lenders

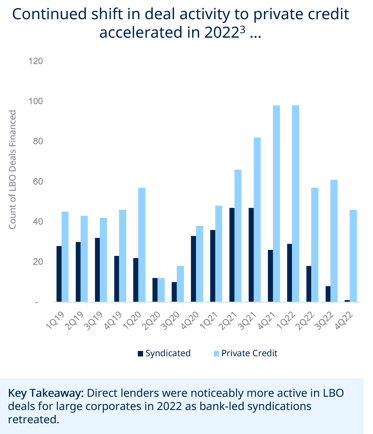

Volatility continues to create significant opportunity for direct lenders. Last year’s market dislocation considerably reduced competition for assets from more capital-constrained direct lenders and, to an even greater extent, from the large commercial and investment banks. For perspective, in 2022 aggregate US high-yield and bank loan volumes fell about 70% year-over-year to $359 billion, marking the lowest issuance total since 2010, according to J.P. Morgan. With banks reluctant to commit to new financings, private equity firms have increasingly turned to direct lenders. Direct lenders have been taking share in the public credit universe for a number of years (estimated at about 20% today, up from about 3% in 2010)2, and this trend has accelerated of late. In 2022 we saw progressively more leveraged buyouts financed in the private credit markets versus prior years, and direct lenders moved further “upmarket,” providing financing for larger, high-quality businesses.

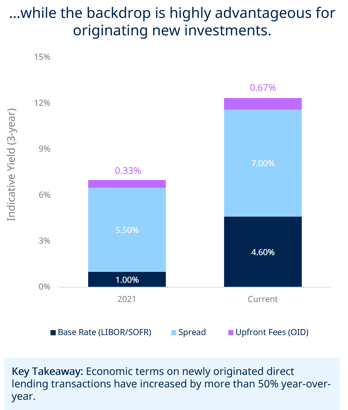

Additionally, with banks on the sidelines for much of the last year, direct lenders have been able to capture better economic and non-economic terms on new loans. Newly originated deals feature asset-level yields of 11% or higher, over 50% higher than they were a year ago from a mix of increased base rates and spread widening. These investments also come with extended call protection, tighter covenant packages and investor protections, as well as increased equity cushions. Even as public credit markets reopen, these trends should persist in 2023, and Blue Owl’s direct lending platform stands to retain an outsized advantage given our scale, strong sponsor relationships, and the substantial amounts of capital we have available to deploy.

2. A downturn may be ahead, but Blue Owl's portfolio is well-positioned

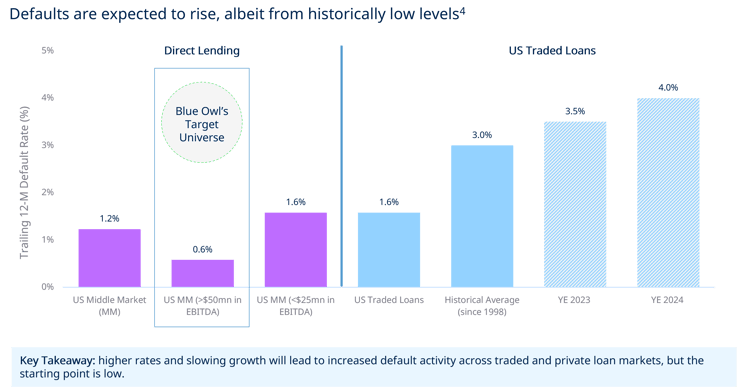

Our portfolio companies are generally entering 2023 from a position of fundamental strength, with substantial cushion in their earnings and financial ratios to weather more uncertain times. That said, investors should expect greater performance dispersion across sectors and issuers this year. Increased borrowing costs will likely push default rates higher in 2023, albeit closer to historical averages given the current low starting point. Importantly, we expect good businesses will be able to navigate challenges while preserving profitability and liquidity. Since inception, Blue Owl has pursued a conservative investment strategy, and we construct our portfolios to thrive across market cycles. We have always focused on stable, upper-middle-market companies with durable business models in non-cyclical end markets. While the portfolio is highly diversified by industry and position, our largest sector exposures include enterprise software, healthcare, and insurance. Our enterprise and other technology companies have attributes that make them compelling investments, including strong customer retention rates and highly-recurring and predictable revenue. The vast majority of our portfolio companies are backed by reputable private equity sponsors, which provide them with access to world-class leadership teams, sophisticated board expertise, strategic capital, and other operational and financial resources.

Looking across our portfolio today, we have not yet seen any broad based erosion in company fundamentals, and our borrowers mostly continue to perform in line with our expectations. Should we encounter issues in the future amid a likely impending economic recession, we believe our platform will be well prepared. As a predominantly first lien senior-secured direct lender, our loans sit at the top of a company’s capital structure—an inherently safer position with historically higher recovery rates amid an environment with increasing credit risks. We provide loans to businesses with conservative LTV profiles, significant sponsor equity, and strict credit documentation, which further protects us from downside risks. Should we experience a rise in defaults, we expect high recovery levels and anticipate that any credit losses will be more than offset by the increased earnings power of our portfolio.

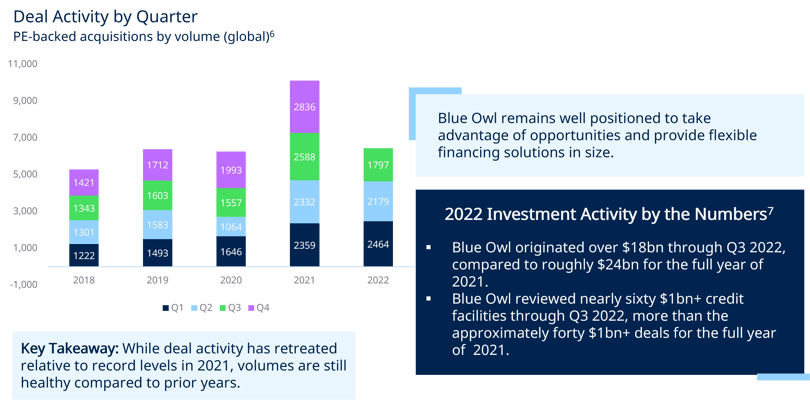

3. Private equity deal activity is slower, but remains robust

Merger and acquisition (M&A) activity moderated in 2022 from all-time highs in 2021, and we expect it to remain muted in 2023. That said, we are still seeing healthy deal flow. According to PitchBook, the private equity industry has over $1 trillion of dry powder, and it stands ready to take advantage of moderating valuations. Meanwhile, direct lenders remain the “lenders of choice” for financial sponsors. Given continued M&A activity and light loan repayments in 2022, we expect capital constraints across direct lending firms to continue. As a scaled direct lender with significant dry powder, we have the ability to be highly selective on the deals we choose to pursue and the terms at which we transact.

As for the sources of deal activity in 2023, we anticipate a continuation of last year’s trends. Take-privates and add-on acquisitions to existing portfolio companies will likely remain areas of activity. As we witnessed in the second half of 2022, we may see more corporate carve outs and divestitures as companies look for ways to generate cash and streamline operations to create value. To the extent that the Fed tones down its hawkish policy earlier than expected, there could be upside to the pace of deal activity in 2023. This would likely be driven by sponsor-to-sponsor trades, which have been largely absent in recent months. In the technology space, we may see more financing opportunities for late-stage, venture-capital-backed companies unable to access the public equity market that are seeking non dilutive capital for growth or liquidity.

4. Manager selection matters

In a strong market, most participants perform well: “A rising tide lifts all boats.” In more volatile times, we would expect a divergence in performance, highlighting the importance of manager selection. Choosing the right partner will ultimately determine an investor’s experience for years to come. While a number of new managers have entered the private credit space over the last few years, the size and scale of Blue Owl combined with our substantial asset base, broad sourcing capabilities, and conservative underwriting philosophy, have made us a consequential player across the private debt market. We continue to observe that larger platforms can benefit from the deepest investment resources, the highest volume and quality of deal flow, and a high degree of portfolio diversification across sponsors, industries, and individual positions.

5. Continued benefits of direct lending in a diversified portfolio

The recent sell-off in public fixed income, credit, and equity markets has underscored the importance of direct lending in a diversified portfolio and why we continue to view the asset class as a strategic, all-weather investment solution. Historically, an allocation to direct lending has helped investors maximize income return potential through illiquidity premiums while minimizing volatility. Relative to fixed income, direct lending has offered high floating-rate income generation and served as a reliable diversifier of interest rate and credit risks. This income has been consistent over time and does not require tactical trading or market timing. In fact, in comparison with high-yield and traded loans, the Cliffwater Direct Lending Index (CDLI) has delivered an average yield pickup of 391 basis points (bps) and 547 bps, respectively, since 2005. As base rates (LIBOR/SOFR) have risen to over 4% today, both existing loans and new originations offer enhanced return potential. For investors further out on the risk spectrum, direct lending can provide risk mitigation in a way that does not sacrifice return. Direct lending assets have also proven the ability to outperform throughout economic cycles, including during prior rate-hiking regimes, downturns, and subsequent recoveries.

In conclusion...

From the very beginning, the primary objective of our direct lending business has been to provide our investors with attractive risk adjusted returns that are purpose-built for any market environment. We focus on downside protection, capital preservation, and investing in high-quality businesses with more conservative capital structures. We have stayed true to this investment philosophy, regardless of the market backdrop over the last seven years, and will continue to do so even as we transition to a higher-yielding, lower-growth environment.

While no one can predict what the coming year will bring, we will continue to partner with our existing portfolio companies and identify new opportunities for our investors.

Craig W. Packer

Co-Founder & Co-President of Blue Owl Capital

Past performance is not a guarantee of future results. The views and opinions expressed herein are those of Blue Owl and are subject to change as markets and other conditions fluctuate. Blue Owl is under no obligation to update or keep current the information presented.

Please see endnotes and important information at the end of this page.