Partnership, Resilience, and Innovation.

Blue Owl's GP Strategical Capital platform, formerly known as GP Capital Solutions, seeks to achieve superior risk-adjusted returns by building a diversified portfolio of minority equity stakes in institutionalized private capital firms spanning multiple strategies, geographies, and asset classes.

While the last twelve months have challenged all markets, including private markets, we believe our funds’ permanent capital and our focus on acquiring stakes in large managers have provided significant downside protection and cash yield during a rather turbulent year. Looking ahead to 2023, we expect the diversification within our portfolios to continue paying dividends for our funds’ investors, both literally and figuratively.

Blue Owl's five investment themes for private strategic capital and GP stakes in 2023

1. Continued and growing allocations to private markets

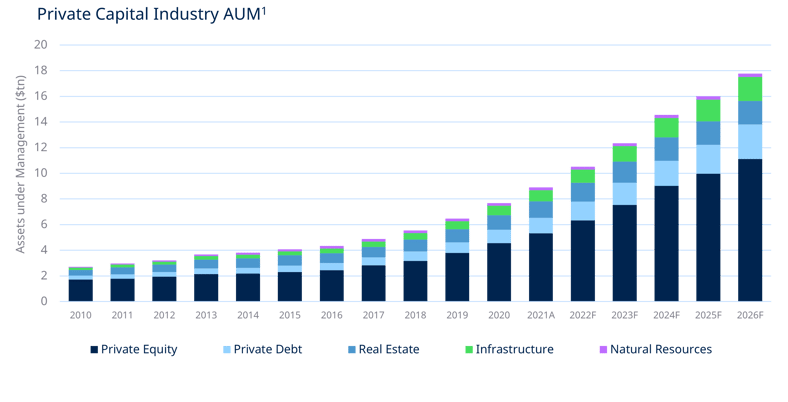

Private market assets under management (AUM) have almost tripled over the last decade and we expect this growth to continue, although likely at a lower rate. Private capital AUM has grown from $2.7 trillion in 2010 to approximately $8.9 trillion in 2021 and is expected to reach $17.8 trillion by 2026, according to Preqin.1 We believe private market funds have become an increasingly indispensable component of institutional investor portfolios due to their potential for attractive risk-adjusted returns, historical outperformance versus other asset classes, and diversification.

Despite significant external factors, such as the global financial crisis and the COVID-19 pandemic, median net internal rates of return (IRR) since 2008 have remained above 10%, with top quartile funds exceeding 15%.1 This indicates that strong returns may be achievable across different market environments. Of particular note for today’s environment: funds deployed during or immediately following economic crises have historically produced above-average returns.

2. Individual investors turning to private capital

Another driver of private market growth is increased individual investor participation in private equity via new structures and delivery models. Per Preqin, individual investors allocate an average of ~5% of their portfolios to alternative investments, as compared to 27% for pensions and 29% for endowments.2 Given the massive size of the potential market, under-allocated individual investors offer a critical and largely untapped growth avenue for private market managers.

3. Big firms getting bigger

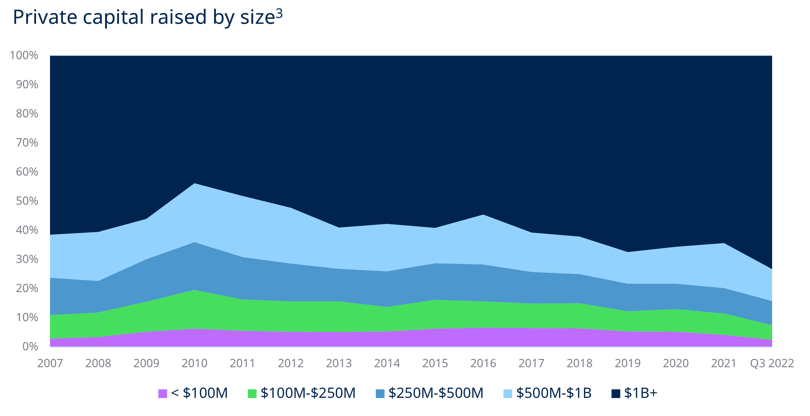

In the private capital industry, mega-funds (i.e., $1+ billion) have accounted for 73.2% of the capital raised through Q3 2022.3 Larger funds have continued to grow, due in some degree to “brand recognition” and years of relationship building with institutional investors. First-time funds, on the other hand, have often struggled in a competitive fundraising market. Following the COVID-19 pandemic, market dynamics have shifted in private market fundraising. While the average length of individual fundraises has increased over the last few years due to the competitive capital raising environment, more firms have exceeded their final close targets. As of Q3 2022, 81.5% of private equity funds have been larger than their predecessors, largely attributable to firms’ relationship building with institutional investors.3 Despite challenges in the market in 2022, global private equity fundraising maintained its pace through the third quarter with $105.3 billion committed across 131 vehicles.3

4. Consolidation

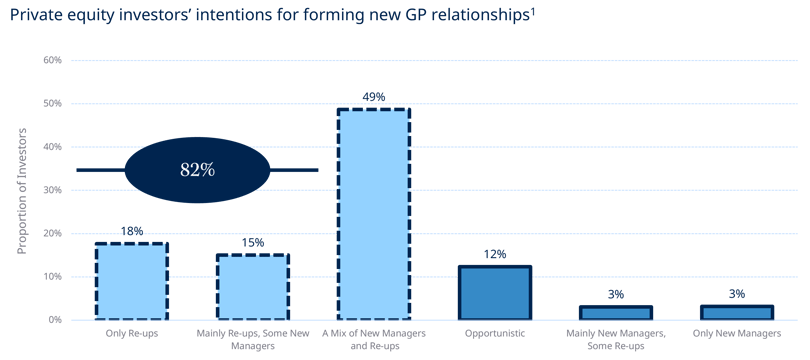

As the private equity industry continues to institutionalize, a disproportionate amount of new capital has flowed to the largest, most diversified private equity platforms. We believe these platforms are attractive to the largest institutional investors for two primary reasons—strong returns, and a broad suite of products through which investors can deploy significant capital. Investors have focused on both consolidating and deepening their relationships with investment managers in order to facilitate easier portfolio management and gain co-investment opportunities. Since 2012, private capital fundraising has continually increased while the number of funds has plateaued, reflecting consolidation in the industry.3 The proportion of capital that has flowed to the largest buyout managers (AUM of $1bn+) has generally continued to increase since the financial crisis. According to an investor survey conducted by Preqin, approximately 82% of investors planned to re-up with existing relationships in 2022.1 We expect this trend to persist into 2023: capital inflows should remain concentrated in fewer funds, further strengthening large incumbent firms.

5. Large addressable GP Stakes market

We believe robust capital flows will continue to drive minority stake sales in the new year. Private capital managers typically sell a minority stake in order to raise primary balance sheet capital, or to provide liquidity for existing equity holders. The demand for primary capital is driven by larger firms launching new products, upsizing their GP commitments, or acquiring new businesses for their platform—all activities that have accelerated in recent years. Secondary capital is generally used for succession planning, equitizing the next generation at a firm, or more generally reorganizing a firm’s capital structure to reflect its evolution over time. In a market with very few buyers, we expect to remain more constrained by available capital than by deal flow.

In conclusion...

Our mission at Blue Owl is to be the partner of choice for large private market firms seeking a minority equity partner. The total addressable market continues to grow with the overall industry. We have completed over 75 equity and debt transactions since inception and we believe our market share of equity transactions larger than $600 million has been over 85%. A range of investors can benefit from owning stakes in large, institutionalized private equity managers, and many have partnered with us to do so. We continue to focus on being a value-add partner with some of the leading private capital managers in the world, and on being a reliable partner and resource to investors.

We wish you a happy and healthy 2023 and remain, as always, at your disposal.

Michael Rees

Co-founder, Co-President of Blue Owl Capital

Founder, Head of Dyal

Sean Ward

Senior Managing Director, Blue Owl Capital

Past performance is not a guarantee of future results. The views and opinions expressed herein are those of Blue Owl and are subject to change as markets and other conditions fluctuate. Blue Owl is under no obligation to update or keep current the information presented.

Please see endnotes and important information at the end of this page.